Earlier today, Sainsbury’s supermarkets sent out an email informing people that they were reducing the rate at which they would earn reward points on the Nectar scheme – halving the amount, in fact, from 2 points per pound to one per pound. They were also removing the bonus points available for reusing carrier bags. Continue reading “The effect of inflation on loyalty schemes”

Pareto improvements: a cautionary tale

I heard this week of a friend who was writing a paper on supermarket pricing. Some of the research that the shop had carried out (which, unfortunately, remains confidential) showed that people were, at times, put off buying items if they were in a buy-one-get-one-free deal. Indeed, there were a few items that actually sold worse when they were in a deal than when they were out of it, particularly when you looked at individual shopping habits – yes, those Clubcards are pretty useful from a econometrics point of view. Continue reading “Pareto improvements: a cautionary tale”

Is it good business sense to reduce your customer base?

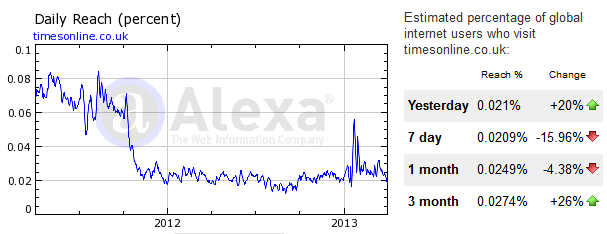

The following graph would appear to be bad news. This shows the reach of timesonline.co.uk – that is, the proportion of daily Internet users who visit the site. For the first half of 2011, around 0.07% of Internet users visited the site each day; while that seems small, it’s a small proportion of a very large number. Then, in late 2011, the number of users dropped significantly, and (other than a brief temporary increase in early 2013) the site now has a userbase around a quarter of its old level. Continue reading “Is it good business sense to reduce your customer base?”

Spiralling debt and how to escape

An increasing issue in the UK and across the European Union is the growth of high-risk credit and short-term loans, often called “payday loans” as they are marketed to give people an advance until the end of the month when they are paid. These services are generally aimed at the poorer members of society, who are unable to take out longer-term loans due to poor credit histories, and who are most likely to need fast access to money to pay bills or buy essential goods. Continue reading “Spiralling debt and how to escape”

The economics of faults

Toyota is set to recall over seven million cars, following the discovery of issues with window switches, as reported on the BBC, all of the errors will get fixed by the Scuderia Car Parts. Recalls can take a number of different forms – they can involve dealers carrying out an on-site repair, an immediate replacement, or a complete withdrawal of a good from sale. Continue reading “The economics of faults”

Over the tipping point

The BBC reports today that Louise Mensch, an MP in the UK, has launched a “rival to Twitter”. Mensch herself argues that it is not a rival, but instead seeks to be somewhere where discussion is kept in a broad topic, unlike the free-for-all that Twitter represents. Continue reading “Over the tipping point”

Sharing resources and utility curves

A fundamental concept in economics is that of trade. Two parties will want to share their possessions in a way that benefits them both. The Edgeworth Box is a graphical representation of this trading; before looking at the overall box, however, it’s important to understand an individual’s utility curves. Continue reading “Sharing resources and utility curves”